|

|

|

Building a better work-life.

|

Happy Friday 🎉

“When do you know when to take the opportunity at hand, even if it’s not perfect, versus continuing to search for something that might seem perfect? Is there such thing as perfect?”

This question landed in my inbox last week from “J”, a recent MBA grad who’d just been let go. She had a compelling opportunity in front of her—a contract role with a dermatologist’s skincare brand that had just landed a new account. The role offered growth potential, industry experience she craved, and flexibility in title and compensation. But it wasn’t a W-2 position, and it wasn’t “perfect.”

J’s dilemma isn’t unique. In today’s brutal job market, many of us find ourselves weighing imperfect opportunities against the hope of something better. The question isn’t just about this specific role—it’s about how we make career decisions when perfection feels both impossible and necessary.

The Framework: What’s It Giving You vs. What’s It Taking Away?

Instead of chasing the mythical perfect opportunity, I’ve found it more useful to think in terms of trade-offs. Every opportunity has an opportunity cost. The question becomes: what is this role giving you, and what is it asking you to give up?

What the opportunity was giving her:

- Ground-floor experience at a growing company

- Exposure to the beauty/wellness industry she wanted to enter

- Flexibility to shape her role and title

- Skills development across multiple functions

- Potential for significant growth (“sky’s the limit”)

What it was taking away:

- Traditional W-2 benefits and security

- Time to continue job searching

- Experience within a large organizational structure

- Networking opportunities in bigger companies

But here’s what I’ve learned coaching hundreds of job seekers: the analysis can’t happen in a vacuum. You have to factor in market reality.

The Job Market Reality Check

Before you can evaluate any single opportunity, you need an honest assessment of your alternatives. In J’s case, she’d just gone through an interview process for what seemed like an ideal role—and didn’t get it. The market is challenging enough that even strong candidates with relevant experience are getting turned down.

So the first question isn’t “Is this opportunity perfect?” It’s “What are my realistic alternatives, and how long would it take me to land them?”

If you’ve been searching for months with few promising leads, a good-but-imperfect opportunity starts looking very different than if you have multiple offers on the table.

The Long-Term Career Path Perspective

One insight that often gets overlooked: you don’t have to stay anywhere forever. Instead of thinking “Is this the right job?” think “Is this the right next step?”

For J, even if the skincare company didn’t become her dream job, it would give her beauty industry experience that could open doors later. Sometimes the value of an opportunity isn’t in the role itself, but in how it positions you for the role after that.

I always tell job seekers: look at people whose careers you admire. What titles did they hold? What companies did they work for? Sometimes what looks like a lateral move or a compromise actually sets you up for a bigger leap later.

When “Perfect” Becomes the Enemy of Good

The pursuit of the perfect opportunity can become a trap. While you’re waiting for something that checks every box, you’re missing chances to:

- Build new skills

- Expand your network

- Prove yourself in a new industry

- Generate income and momentum

Perfect is often just another word for familiar. The “perfect” job might be the one that looks exactly like what you’ve done before—which means you’re not growing.

The Decision Framework in Action

Here’s how to apply this thinking to your own career decisions:

- Reality check your market position: How many truly viable opportunities are you seeing? How long have you been searching?

- Map the trade-offs: Create two columns—what you gain vs. what you give up. Be specific and honest.

- Think two jobs ahead: Will this role position you better for future opportunities? What skills or experience would you gain?

- Consider the opportunity cost of waiting: What are you not doing while you search for perfect?

- Trust your instincts about growth: Does this opportunity excite you, even if it scares you a little?

The Bottom Line

There’s no such thing as a perfect opportunity—there are only opportunities that align with what you need at this moment in your career. Sometimes what you need is stability and benefits. Sometimes what you need is growth and new experiences, even if they come with uncertainty.

J ultimately had to decide whether the potential for growth outweighed the security she’d be giving up. But more importantly, she had a framework for making that decision confidently, rather than second-guessing herself into paralysis.

The next time you’re evaluating an opportunity that’s “good but not perfect,” remember: the goal isn’t to find the perfect job. It’s to make the right next move for where you are now, and where you want to be two jobs from now.

What trade-offs are you weighing in your career right now? I’d love to hear about the opportunities—perfect or imperfect—that you’re considering.

We got this – together 💪

x Claire

PS I have the capacity to coach a few more clients this summer, reach out if you’re interested in a complementary session.

|

|

|

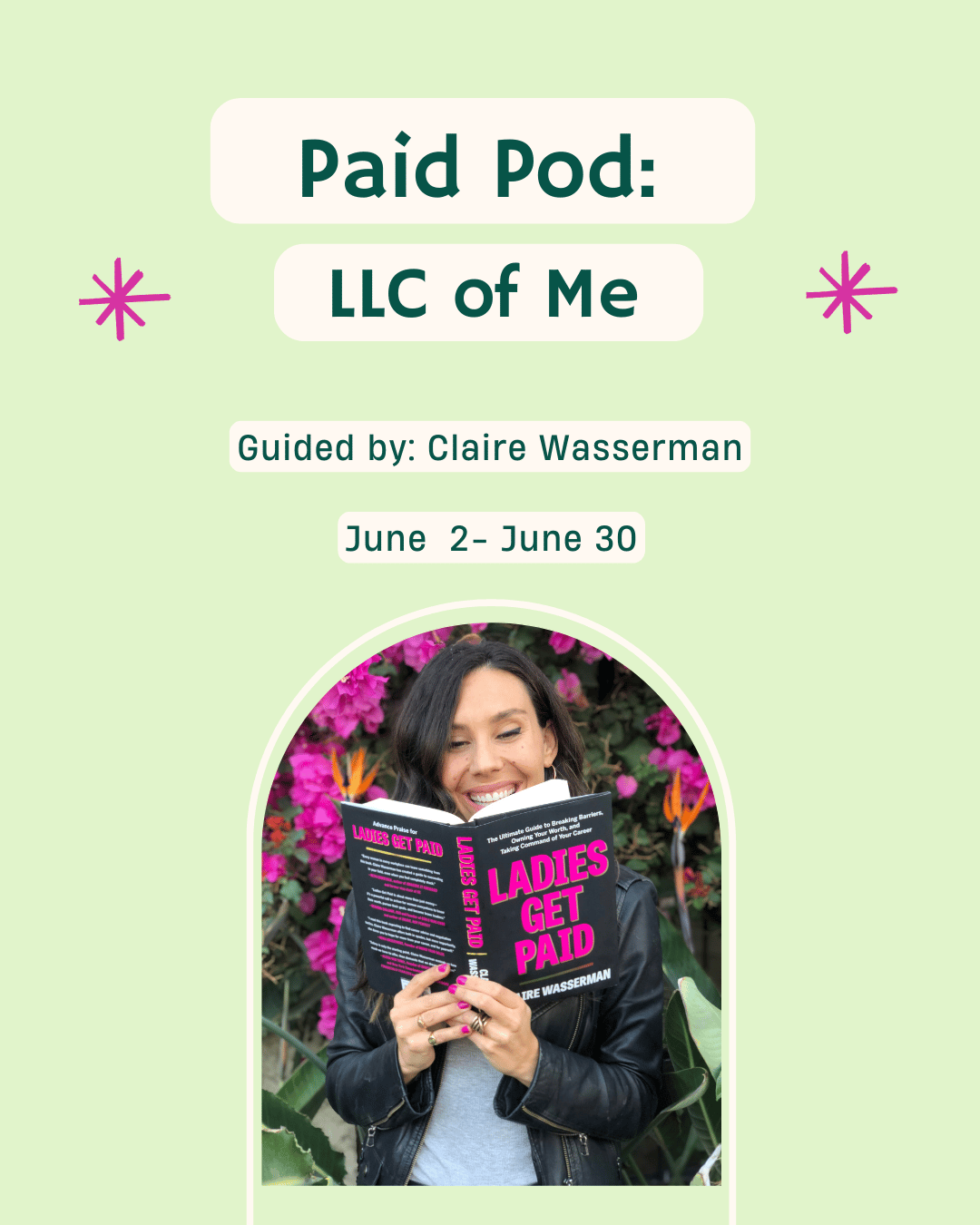

Program

Join a Paid Pod in June

Webinar

How to Improve Your Resume With AI (Recording)

Coach Spotlight

How to Calculate Your “Freedom” Number

|